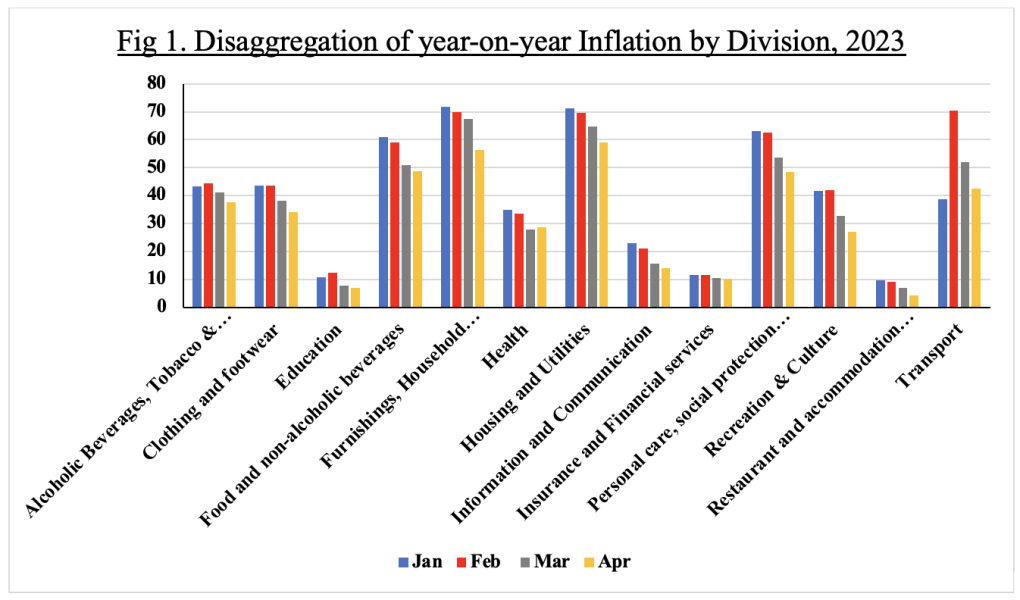

Data released by the Ghana Statistical Service (GSS) on May 10, 2023, indicates that the annual inflation rate decreased to 41.2% in April 2023 from 45.0% recorded in March 2023. This marks a fourth consecutive decline in the growth rate of the consumer price index (CPI) since peaking at 54.1% in December 2022. The data also shows a decline in the Bank of Ghana’s (BoG) preferred core inflation measure (Core 1), which excludes volatile components of the CPI such as fuel and utilities. Figure 1 illustrates that the disinflation is broad-based and can be observed across all 13 divisions of the CPI basket.

Source: Ghana Statistical Service (GSS)

Despite the headline inflation rate being more than four times the upper bound of the Bank of Ghana’s target of 6% to 10%, the fall in the inflation rate is positive news for the economy and people of Ghana. It indicates that the Bank of Ghana’s efforts to dampen inflationary pressures through contractionary monetary policies is beginning to have a significant effect on the economy. The bank has tightened its monetary policy stance by increasing the policy rate by a total of 15% since the beginning of 2021. In addition, the Bank has more recently been aggressively mopping excess liquidity in the banking system, with the March 2023 monetary policy report showing a significant increase in open market operation (OMO) sterilization in February 2023.

While it is encouraging to see inflation falling in Ghana, the Bank of Ghana cannot afford to be complacent. As the Monetary Policy Committee (MPC) of the central bank begins its 112th Regular meeting on May 17, 2023, a section of market participants believes that the recent decline in inflation rate should compel the MPC to keep the policy rate unchanged at 29.5%. However, we believe that the MPC should continue on the path of raising the policy rate.

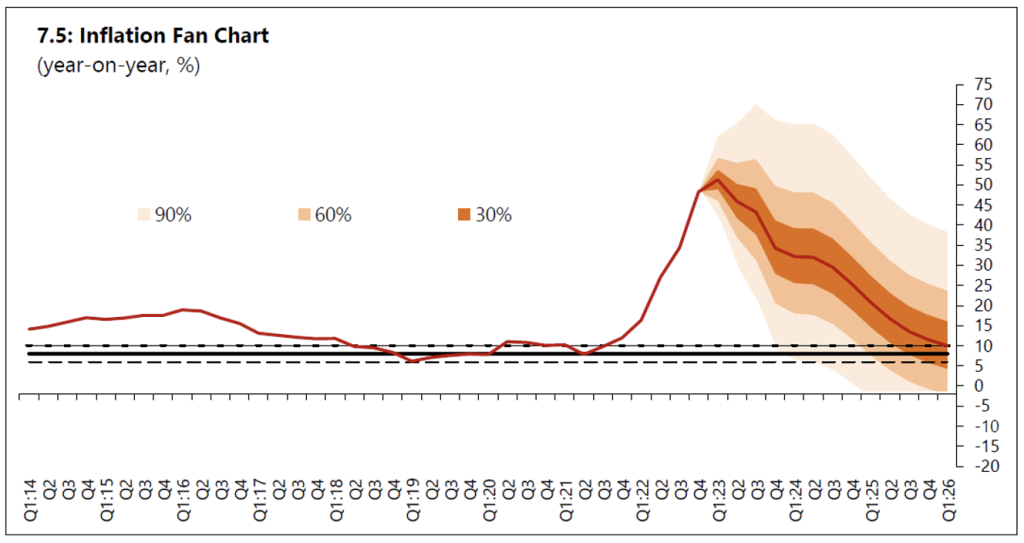

We believe that the recent decline in inflation rate is consistent with the latest inflation forecast by BoG staff, as shown in Figure 2. The forecast indicates that headline inflation is projected to slow down but remain above the upper band of the target range until the end of 2025. It must be noted that this projection is based on well-anchored inflation expectations and is strongly supported by a tight monetary policy stance.

Fig 2. March 2023 Inflation Forecast

Source: Bank of Ghana (BoG)

Our analysis indicates that the current policy rate of 29.5% (and a real rate of -11.2%) is not restrictive enough to return inflation to the target range by the end of 2025. To reinforce the pace of recent disinflation and anchor inflation expectations toward the target range of 6% to 10%, the MPC should not fall for the temptation to leave the policy rate unchanged. Instead, we recommend implementing a prudent increase in the policy rate within the range of 50 to 150 basis points to effectively address the prevailing circumstances.

Written by

Dennis Nsafoah

Assistant Professor of Economics

Niagara University, NY

Member of Research Committee, Tesah Capital

&

Elikplimi Komla Agbloyor

Associate Professor, Department of Finance, University of Ghana Business School.

Chair of Research Committee, Tesah Capital

Data Scientist (Machine Learning and Artificial Intelligence Applications in Business)