While investors especially foreigners may find it economically viable to invest in developing countries, credit quality reports that evaluate the creditworthiness of a country are considered essential for investment decisions and cannot be ignored.

Ghana has maintained its sovereign credit ratings for the past three (3) years (2017-2019). The Sovereign Credit Rating (SCR) assigned to Ghana by Fitch has remained at ‘B’ since 2017 with a stable outlook until the firm downgraded Ghana’s outlook from stable to negative in June 2020. Moody’s also changed the country’s outlook from positive to negative in April 2020, owing to the adverse impact of the Covid-19 pandemic on economic performance and prospects. Although the economic shock of the Covid-19 pandemic placed enormous budgetary pressure on governments due to the measures taken to contain the virus, Ghana, unlike many of its developing counterparts, maintained its sovereign ratings above ‘C’ (those that are considered to be in poor standing and a very high credit risk) by Moody’s. Fitch and Moody’s maintained Ghana’s ‘B’ and ‘B3’ with a negative economic outlook in June 2021 and September 2021 respectively.

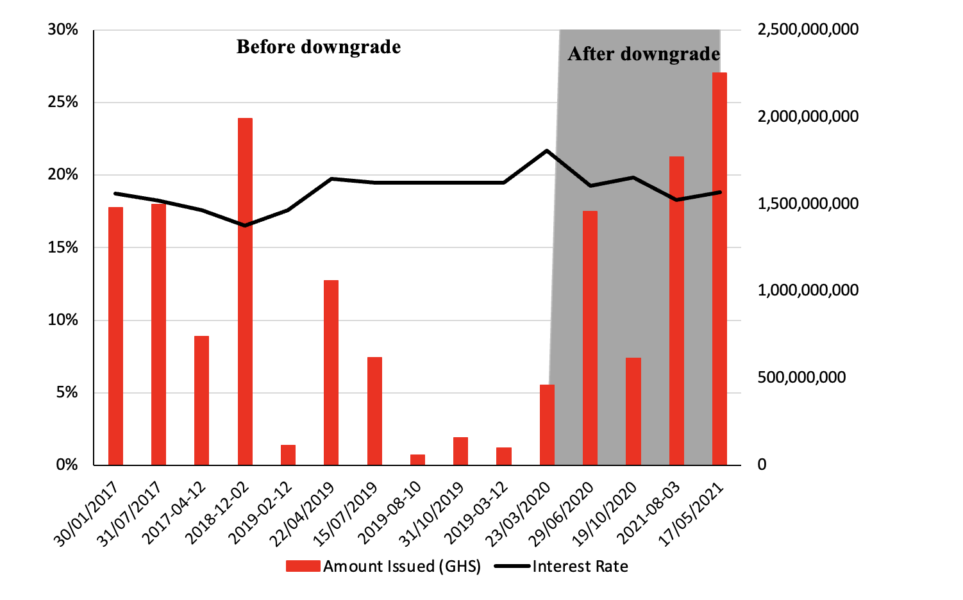

There is a conventional view that, a downgrade in credit ratings negatively affects interest rates and investments. Indeed, it appears to justify the premium demanded by investors during the Eurobond issuance in April 2021. (The 12-year bond was issued at 8.60% in April 2021 versus 8.10% for the same tenor in March, 2019). The high coupon rate demanded by investors, caused the government to accept USD 3 billion out of the US$5 billion targeted. While SCR remains a concern for both local and international investors because of their creditworthiness opinions, analysts question whether credit ratings do matter for domestic debt. This is because yields across the maturity curve for domestic debt trended downward during the period under review. For instance, the yield on the 5-year GoG bond declined from 21.70% in March 2020 (prior to the SCR downgrade by Moody’s) to 19.25% in June 2020 (after a downgrade by Moody’s from B3, Stable Outlook to B3, Negative Outlook). Please see the Graph below.

Trend in Interest Rate and Amount Issued (5-year GoG Bond)

Demand for GoG securities remained strong despite the downgrade in Ghana’s credit position. This is due to a stronger pace of growth in total liquidity. (Broad money supply (M2+) increased, on a year-on-year basis from 14.8% in April 2020 to 27.8% in April 2021), the perceived safe haven of treasury securities and the lack of other investment opportunities that offer better returns at low risk. Trading volume on the Ghana Fixed Income Market increased by 129.74% from GHS 55.55 billion in FY2019 to GHS 1270.7 billion as at 1H2021. The downgrade in Ghana’s credit position has not shifted foreign investor behaviour as net monthly purchases of securities on the debt remain relatively favourable owing to the country’s higher sovereign spread. Foreign investor participation in the local market increased significantly by 214.84% during the same period to GHS 30.68 billion.

In spite of this, rising interest rate expectations due to the tightening of global financing conditions in advanced economies could pose a risk to portfolio flows to emerging economies like Ghana.

Analyst: Ruth Atobrah Amofa

Sources: Bank of Ghana, https://www.moodys.com/, https://tradingeconomics.com/.

THIS IS PUBLISHED SOLELY FOR INFORMATIONAL PURPOSES. ALL EXPRESSIONS OF OPINION ARE SUBJECT TO CHANGE WITHOUT NOTICE. THE INFORMATION IS OBTAINED FROM INTERNAL AND EXTERNAL SOURCES WHICH TESAH CAPITAL LIMITED CONSIDERS RELIABLE BUT HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION AND DOES NOT GUARANTEE THAT IT IS ACCURATE OR COMPLETE