Introduction

In this article, I discuss the concept of asset securitization. Of course, a whole book can be written on this topic. What I do here, is to focus on the key elements and provide a summary that I hope will deepen understanding in this area. Securitization is a seasoned tool for raising funding and managing risk by banks globally. However, these instruments are still in the embryonic phase in Ghana. I believe that the various regulators should work expeditiously with banks to grow this market in Ghana. This is because it has a huge potential of providing funding benefits to banks as well as helping them manage the cocktail of risks they are exposed to such as interest rate risk, credit risk, liquidity risk and regulatory capital charges. Indeed, successful securitization has various benefits also for investors and society at large since more people can also access loans from banks. Given the growing assets under management (AUM) for pension funds and the lack of investment opportunities, the mortgage-backed security (MBS) market may provide a useful outlet for pension funds. Of course, asset securitization is not without risks. The global financial crisis between 2007 and 2009 was triggered by credit sensitive assets (CSAs) that formed the basis for various complex asset securitization structures.

Antecedents of Asset Securitization

It is well known that a good and vibrant financial system can promote economic growth and development. This is what has been termed the ‘Finance Led/Supply Side’ hypothesis in the empirical literature. As Schumpeter explains, the financial system facilitates what is known as creative destruction by channeling funds to businesses and technologies that have the potential to change the way of doing things. The basic function of the financial system or more specifically banks is to transfer funds from surplus units (those who have excess funds in their bank accounts like individuals, businesses and governments) to productive deficit units (those who require funds to undertake a particular venture). This process is referred to as financial intermediation. In performing this financial intermediation role, banks accumulate assets in the form of loans and investments (such as bonds) and liabilities in the form of various types of deposits. The owners of the bank also supply equity capital which serves as a source of funding for the bank. Traditionally, banks keep these assets on the balance sheet until maturity. Some of these loans can pose challenges to the bank in the form of maturity mismatches for example. This occurs because the resources used to fund a loan (deposits) are usually of a short-term nature. However, the loans held by the bank usually have longer maturities such as auto-loans, mortgage loans and loans to businesses. In the 1970s mortgage banks in the United States invented a means of offloading these loans from their balance sheets through the asset securitization process.

The Design and Key Parties in an Asset Securitization Structure

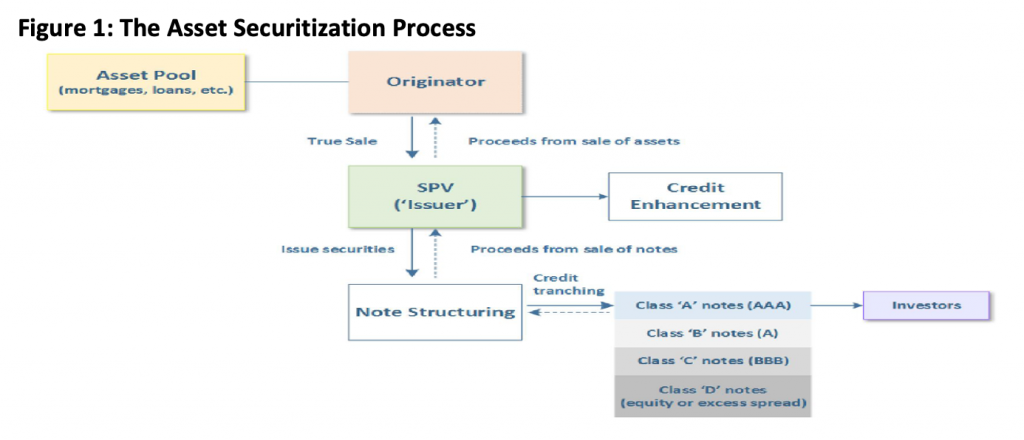

In the securitization process a bank pools together loans that it has generated to its clients. These loans are then sold indirectly to investors in the capital markets. The loans serve as collateral for the securities (typically bonds) that are issued to investors. Securitizations based on mortgages are known as mortgage-backed securities (MBS). Securitizations based on other assets such as auto-loans, credit card loans, airline tickets revenue, lease payments and museum entry fees are generally referred to as asset backed securities (ABS).

The bank is known as the originator or sponsor. The loans are then sold to an entity specifically set up for this purpose. This entity is known by various names such as special purpose vehicle (SPV), Special Purpose Entity (SPE), Special Purpose Companies (SPC) and Special Investment Vehicles (SIVs). This entity is supposed to be a bankruptcy remote entity meaning that the bankruptcy of the originating bank should have no effect on the SPV. Of course, legal risks remain if the courts do not interpret the transfer of the loans to the SPV as a true sale. The transfer or sale is one of the means of providing credit enhancement to the vehicle as the loans issued by the SPV can be credit rated separately from the originating bank. In many cases, the securities issued by the SPV for which the loans serve as collateral can achieve a higher credit rating than the originating bank. This is achieved through various means such as tranching and the design of the waterfall. These terms will be explained shortly. The SPV works together with an investment bank which is typically referred to as the arranger. The arranger is responsible for structuring the securities to be issued. The arranger also performs due diligence on the assets to be securitized. The arranger is also responsible for helping with pricing of the issue and helps with marketing and distribution of the issue.

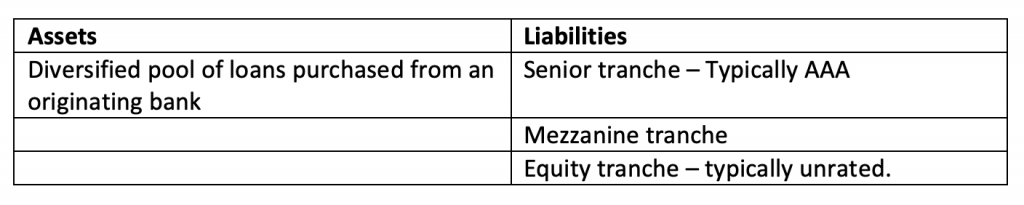

Usually, three main tranches are created in the tranching process. The first is a senior, highly rated tranche (typically AAA). The next is a mezzanine tranche which is subordinate to the senior tranche (typically below AAA) and the last is the ‘equity’ tranche which is typically unrated. In terms of the distribution of cash flows or the waterfall, payments are first made to the senior bond holders, then the mezzanine bond holders and finally the ‘equity’ tranche if there are remaining cash flows. Consequently, the senior tranche is the safest, followed by the mezzanine tranche and finally the equity tranche. The tranched securities are referred to as Collateralized Debt Obligations (CDOs). If the assets are based on bank loans, then they are called Collateralized Loan Obligations (CLOs) or if they are based on bonds held by the bank then they are called Collateralized Bond Obligations (CBOs). By tranching the securities, the securities are better tailored towards the risk and reward preferences of various investors. Institutional investors who desire safe assets can invest in the senior tranches. Pension funds in Ghana for example can invest in the senior tranche. Given that these are bonds with medium to long-term maturities, it provides an excellent match for pension funds given that their liabilities (pension payment obligations) are of a long-term nature. Investors that want a moderate level of risk can invest in the mezzanine tranche and those that seek high risk such as hedge funds can invest in the equity tranche.

In summary the assets of the SPV are the loans purchased from the originating bank and its liabilities are the tranched securities issued to investors in the capital markets.

Figure 1 below provides a visual illustration of the players involved in the AS process.

Credit Enhancement

We mentioned earlier that one of the means of providing credit enhancement is through the design of the tranche and the waterfall structure. The rating of the securities issued by the SPV is also another means of providing credit enhancement. The ratings of these securities were done by the well-known agencies such as Moody’s, Standard and Poor’s and Fitch Investor Services. Following the financial crisis in 2007, these rating agencies were criticized for not doing a thorough assessment. Further, due to the fact that companies seeking ratings shopped around various agencies and were the ones who paid the rating agencies, the rating agencies in many cases provided favourable opinions to win business from these companies.

There are a number of other important means of providing credit enhancement to the structure developed which I will discuss. These include financial guarantees, over-collateralization and the excess spread. Financial guarantees through an insurance company (monoline insurance companies) provided a deal wrap for the senior tranches. In essence, the insurance company will step in to make payments to investors if there were large defaults on the underlying pool. Over-collateralization is the situation where not all the loans in the pool (asset side) are issued as securities (liabilities). This enhances the quality of the securities issued. In terms of the excess spread, not all the returns on the loans are paid out as interest on the securities issued. For example, the overall return on the loans issued may be 15% but the securities issued may on the average pay out say 12%. This provides another buffer and increases the security of the structure. The excess spread typically goes into a reserve fund which is used to make payments in the event of default on some of the loans. Thus, while overcollateralization takes a balance sheet view, excess spread takes an income statement view.

Benefits of AS

For banks, the asset securitization (AS) process allows them to focus on lending or originating loans where they have the greatest strength. Banks develop relationships with firms and individuals through ‘relationship lending’ and therefore have a big advantage in originating loans. Investors in the capital markets on the other hand have an advantage in providing funding and assuming risks such as liquidity, interest rate and credit risk. Thus, banks can earn origination fees and also earn servicing fees by continuing to perform the administrative functions associated with the loan. Further, the AS process allows banks to more efficiently manage their capital. If the loans remained on the balance sheet, they would have received a high capital charge. Thus, securitization allows the bank to channel its capital into areas that it can make more money. Indeed, the introduction of Basel 1 was a key impetuous to the growth of the AS markets. Banks could offload their loans to an SPV reducing their capital charge because these SPVs were not treated as banks. The bank may have had no intention of transferring the assets to investors but can still benefit from the reduced capital charge. This is what was termed as ‘regulatory arbitrage’ or the shadow banking system. New rules are being designed to reduce this kind of regulatory arbitrage.

Importantly, AS provides banks with a funding benefit, since they can originate new loans or use the funds received from the securities sold to enter into new and profitable areas. Further, the AS process helps to lower the funding cost of the bank due to various credit enhancements and the fact that the newly issued securities are typically highly rated even compared to the rating of the originating bank. In addition, the AS process allows banks to manage their maturity mismatch. The bonds issued on the back of the bank’s loans are typically of a longer term (5 – 7 years) compared to the deposits which were used to initially fund the loan and therefore more accurately track the maturity of the bank’s loans. For investors, the AS process allows them to invest into a diversified pool of assets that traditionally were illiquid and difficult to access. In Ghana, AS can provide investment options to the growing private pension fund management industry. For businesses and households, they can borrow at lower rates and access higher amounts of loans due to the funding benefits achieved by banks.

Risks of AS and Reforms after the Global Financial Crisis

As mentioned earlier, if incentives are not well aligned, the AS process can bring the entire financial system to its knees. One of the areas of agreement is that a number of banks issued loans that were not of very high quality (sub-prime and alt A loans) and offloaded these loans to investors. The banks had no interest in these loans as any losses would be borne by investors. One of the proposals to manage risk and align incentives after the 2007 financial crisis is for the sponsoring bank to maintain a piece of the securities issued (usually the riskiest or equity tranche). By doing so, banks know that if they originate bad loans, these loans will come back to bite them in the future since they will bear large losses if the loans default on a massive scale. Further, some of the structures such as CDO squared (where the securitization was based on another CDO and not an original loan) became very opaque (high information asymmetry). Structures such as this have reduced drastically or almost dried up after the global financial crises. Further, perhaps, credit rating agencies will want to protect their reputations and franchise value by not offering ratings to potentially damaging structures. Indeed, after the financial crises, these agencies withdrew their ratings for some of these structures.

Written By:

Elikplimi Komla Agbloyor

Senior Lecturer, Department of Finance, University of Ghana Business School

Chair of Research Committee, Tesah Capital